For many online merchants, legal and tax considerations still present a hurdle when accepting Bitcoin payments–Bitcoin accounting seems complicated! One of the main reasons is the tax treatment of Bitcoin and the question of how Bitcoin payments should be recorded in accounting systems.

In this article, we explain:

- How to record Bitcoin payments in your online store’s accounting

- How to prove receipt of Bitcoin in your Bitcoin wallet

- How to document all Bitcoin transactions using Coinsnap

- How to download all Bitcoin transactions as a CSV file for further processing in other systems

- How to further process Bitcoin transactions using CoinTracking

Is Bitcoin payment receipt provable for tax purposes?

Yes. Bitcoin payments are provable through wallet transaction records, blockchain data, and payment processor dashboards such as Coinsnap, which document the transaction amount, exchange rate, and order reference.

How Bitcoin Payments Are Booked in an Online Store

Before focusing on Bitcoin-specific accounting details, it is important to understand how orders and payments are processed in an online store in general. From an accounting perspective, Bitcoin payments follow the same workflow as traditional payment methods: an order is placed, an invoice is issued in fiat currency, and the payment is recorded against that invoice. The differences arise only at the payment settlement stage—not in the order or invoicing process itself

How do merchants account for Bitcoin payments?

Merchants account for Bitcoin payments by issuing invoices in fiat currency, recording the Bitcoin amount received at the exchange rate at the time of payment, and documenting the transaction in their accounting system or tax software.

Order Creation and Invoice Issuance

A customer orders a product in your online store for €100, for example, and the store system generates an invoice for this order.

The invoice is issued in the local currency of your country (in Europe, euros), includes VAT, and contains all legally required tax and invoice information.

Payment Processing: Bitcoin vs. Traditional Methods

The customer is prompted to pay the invoice.

It makes no difference whether the payment is made by credit card, PayPal, or Bitcoin.

Once payment has been successfully completed, the store system marks the invoice as paid and the merchant can proceed with shipping the ordered goods.

How Bitcoin Payments Are Credited

If the customer pays by credit card or PayPal, the merchant receives a transaction statement from the payment service provider and a corresponding credit to their bank account.

With Bitcoin, merchants can choose whether the funds are credited to a bank account or retained as Bitcoin in their own wallet.

Bitcoin Settlement to a Bank Account

If you prefer to have your Bitcoin turnover paid out to your bank account, you can activate bank settlement via your selected Coinsnap payout partner.

Incoming Bitcoin payments are automatically forwarded to Bringin, Strike, or DFX and sold there. The fiat equivalent is transferred directly to your bank account, ensuring that each invoice can be clearly assigned to and documented against the corresponding incoming payment.

Bitcoin Settlement to Your Own Lightning Wallet

Most merchants who accept Bitcoin payments prefer to retain the Bitcoin they receive, either privately or within the company.

It is strongly recommended to use separate wallets in order to clearly distinguish business Bitcoin from private holdings.

Coinsnap requires a Bitcoin wallet with a Lightning address to which payments are credited. Supported wallets include Strike, Wallet of Satoshi, Blink, Breez, and others.

The Strike wallet, for example, allows the use of both a private wallet and a dedicated business wallet. If you already use a Lightning wallet privately, it is advisable to use a separate wallet for your company.

Bitcoin Settlement to Your Own Bitcoin Wallet

A Bitcoin Lightning wallet is suitable for receiving Lightning payments, but it is not intended for receiving on-chain payments or for long-term Bitcoin storage. For long-term storage, Bitcoin should be transferred to a secure hardware wallet such as BitBox02, Ledger, or Trezor.

Hardware wallets allow the creation of multiple accounts, enabling a clean separation between private and company Bitcoin holdings. Bitcoin balances can then be transferred from the Lightning wallet to the hardware wallet.

To deposit your Bitcoin directly into your hardware or Bitcoin on-chain wallet, simply enter your xPub key or your personal Bitcoin address in the Coinsnap settings.

The Bitcoin addresses of hardware wallets are publicly verifiable, allowing transparent documentation of how much Bitcoin the company holds at any time.

Documentation of the “Bitcoin Purchase”

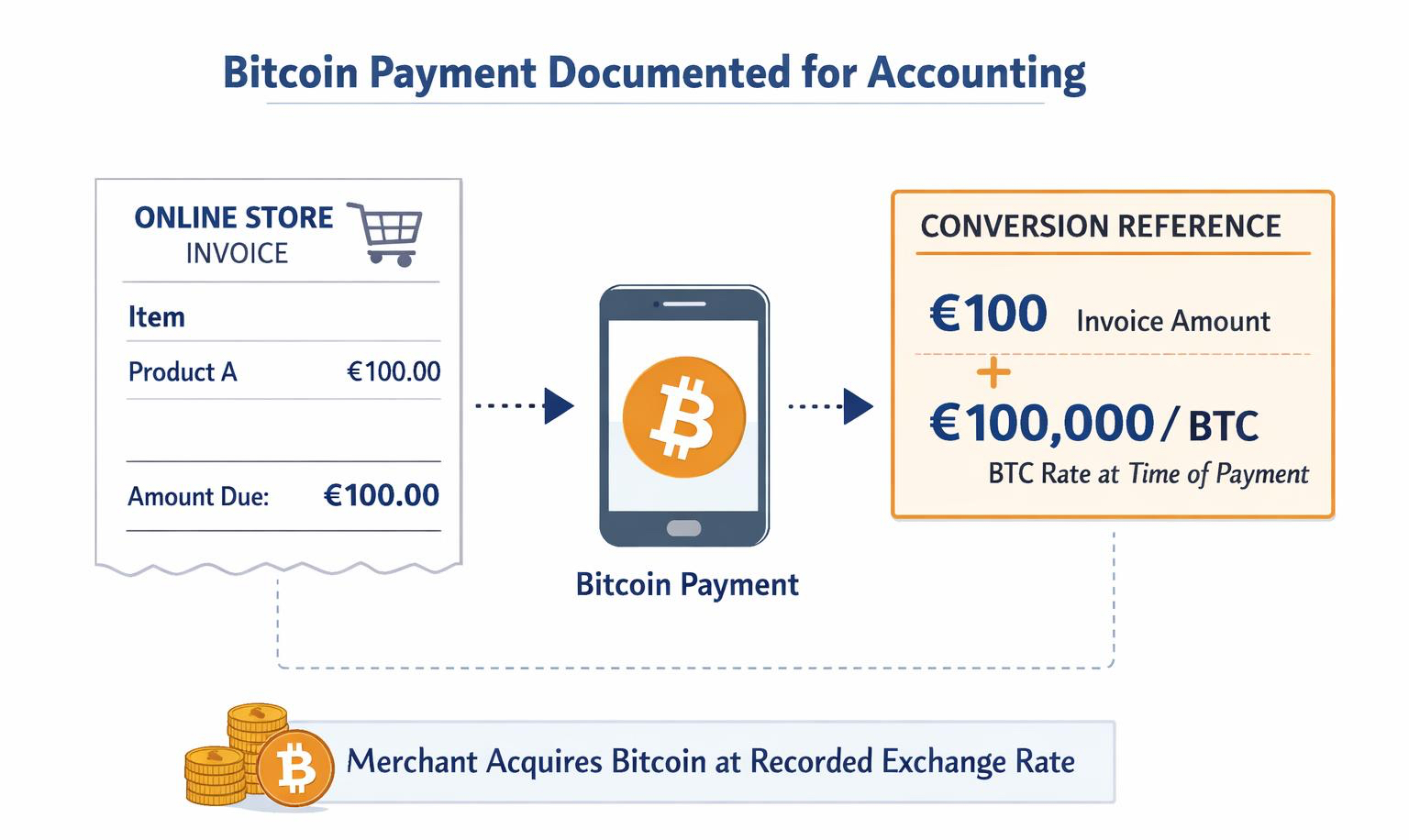

When a customer pays with Bitcoin, the transaction is economically equivalent to the company purchasing Bitcoin from the customer.

The Bitcoin amount received and the applicable exchange rate at the time of payment must therefore be documented.

For example, if a customer purchases a product for €100 and the Bitcoin price at that time is €100,000, the company receives 0.001 BTC (100,000 satoshis).

Coinsnap displays this information in detail for each individual transaction in the Coinsnap dashboard, including the Bitcoin amount, exchange rate, customer reference, and the corresponding order in the online store.

All transaction data can be downloaded as a CSV file and transferred to other systems.

The data can also be imported into CoinTracking, where it can be evaluated for accounting purposes or provided to a tax advisor. Coinsnap will soon offer an automated data-export feature that forwards all relevant transaction data directly to tax software solutions such as CoinTracking and 3Folio, enabling seamless and compliant tax reporting without manual effort.

Can Bitcoin transactions be exported for accounting software?

Yes. Coinsnap allows merchants to export all Bitcoin transactions as CSV files, which can be imported into accounting tools or tax software such as CoinTracking.

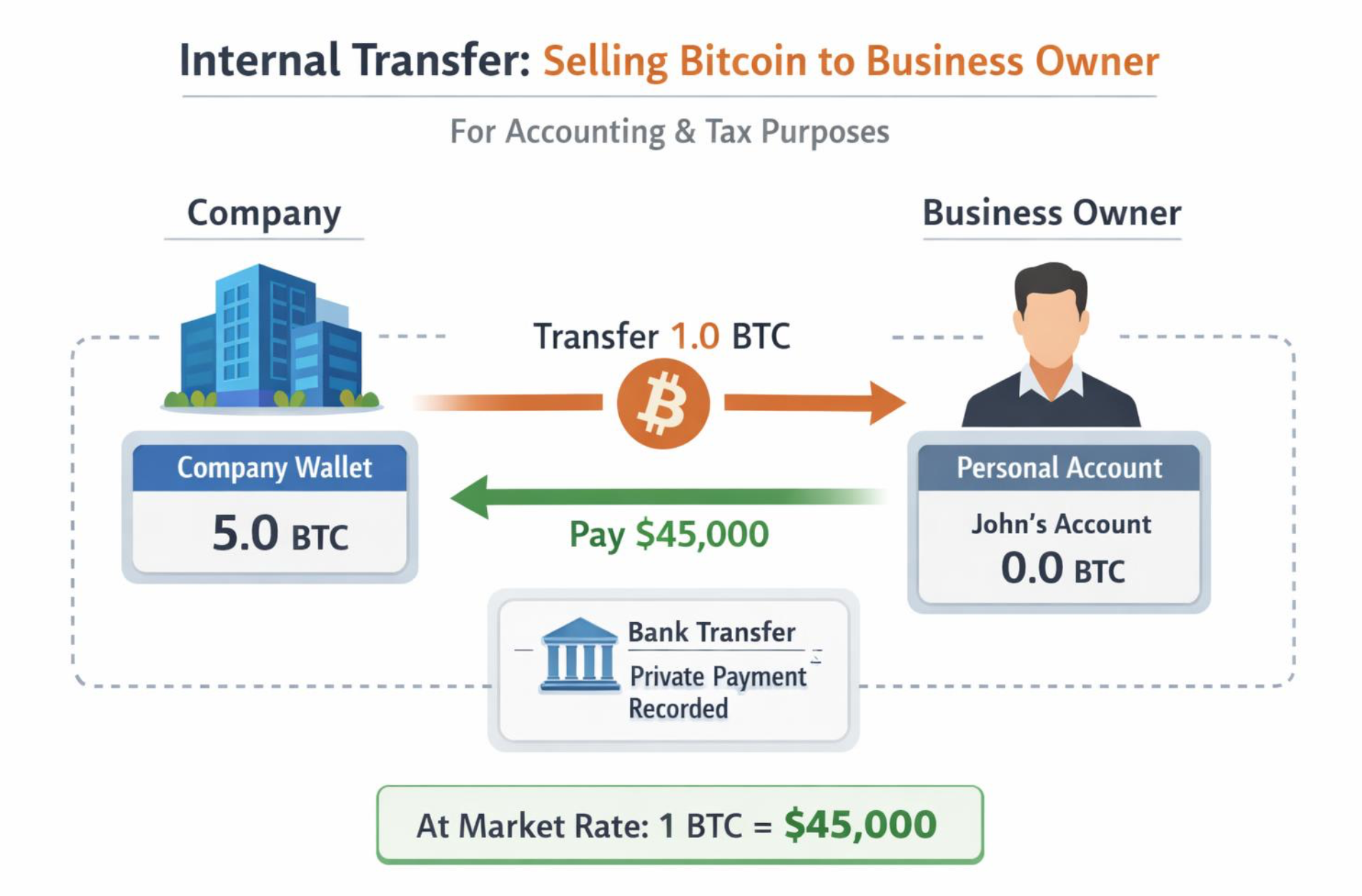

Buying Bitcoin Privately from Your Company

Whether the Bitcoin received remains within the company or is sold immediately—either to a Bitcoin broker or to the business owner privately—depends on individual preferences and circumstances.

In many cases, Bitcoin sales volumes will initially be low, making immediate liquidation unnecessary for covering operating expenses.

However, there may be reasons not to hold Bitcoin on the company balance sheet. For example, a co-shareholder may not wish to hold Bitcoin as an asset due to its volatility, while still appreciating its advantages as a payment method.

Instead of purchasing Bitcoin privately on an exchange, it is also possible to buy Bitcoin directly from your own company. The timing of this transaction and the applicable Bitcoin price can be relevant.

For example, you may conclude an agreement under which you buy the received Bitcoin from the company immediately at the current exchange rate.

Payment for the Bitcoin purchased from the company can be made via bank transfer from your private account to the business account, or alternatively recorded as a private withdrawal.

In all such cases, consultation with a tax advisor is strongly recommended, as the correct treatment depends on the individual legal and tax situation.

Is accepting Bitcoin treated as a Bitcoin purchase?

From an accounting perspective, accepting Bitcoin is equivalent to acquiring Bitcoin at the exchange rate valid at the time of payment.

Summary: Bitcoin Accounting with Coinsnap

Uncertainty around tax and accounting treatment continues to prevent many online merchants from accepting Bitcoin payments.

As with any payment method, accounting requires clear documentation of which invoices have been paid, where the payment was received, and the resulting balance—whether in a bank account or, in the case of Bitcoin, in a wallet.

With Bitcoin payment processing via Coinsnap, these documentation and verification requirements can be fully met. Each Bitcoin payment is recorded at the applicable exchange rate at the time of the transaction, and every wallet transaction is documented individually, similar to a bank statement.

All transaction data can be exported, imported into other systems, and used for accounting and tax purposes. Like an account balance, Bitcoin holdings are precisely recorded and can be independently verified by anyone via the blockchain.

FAQ

Does Coinsnap hold merchant funds?

No. Coinsnap never holds Bitcoin or fiat funds. Payments are credited directly to the merchant’s wallet or settled via an external payout partner.

Can Bitcoin payments be settled in euros?

Yes. Merchants can choose automatic settlement to a bank account via Coinsnap payout partners such as Strike, Bringin, or DFX.

Are Lightning payments suitable for long-term Bitcoin storage?

No. Lightning wallets are intended for payment reception. Long-term storage should be done using a secure hardware wallet.

Is Bitcoin accounting different from card payments?

The invoicing process is identical. The difference lies in documenting the Bitcoin amount and exchange rate instead of a bank transaction.