You want to accept Bitcoin, but prfer to get paid to your bank account in euros? If you’re curious about offering Bitcoin at checkout—but have zero interest in managing wallets, volatility, or crypto accounting—this guide is for you.

With Coinsnap, your customers can pay in Bitcoin while you choose how you get paid:

- directly to your bank account in euros or dollars, or

- to a Lightning or on-chain Bitcoin wallet if you prefer.

In this post, we focus on the simplest path for non‑crypto‑native businesses: accepting Bitcoin while receiving fiat directly to your bank account. You’ll learn why bank settlement is appealing, how it works with Coinsnap, and which payout partner—Bringin, Strike, or DFX—is right for you.

Can Merchants Accept Bitcoin and Get Paid in Euros?

Yes. With Coinsnap, customers pay in Bitcoin while merchants receive EUR or USD directly to their bank account via regulated settlement partners such as Bringin, Strike, or DFX—without holding or managing Bitcoin.

Why Merchants Settle Bitcoin Payments to a Bank Account

Many businesses want access to new customers without changing how finance works day to day. Bank settlement keeps everything familiar:

- Sales arrive as euros or dollars on your statement

- No Bitcoin custody or wallet management

- No exposure to price volatility

- Easier bookkeeping and reconciliation

When you choose fiat settlement, Coinsnap routes payments through a regulated partner that handles conversion and banking rails. As with any fiat service, KYB/KYC onboarding is required by the partner—not by Coinsnap.

Coinsnap itself never holds your funds. You decide whether payments go to a Lightning wallet, an on‑chain wallet, or a bank account via a settlement partner.

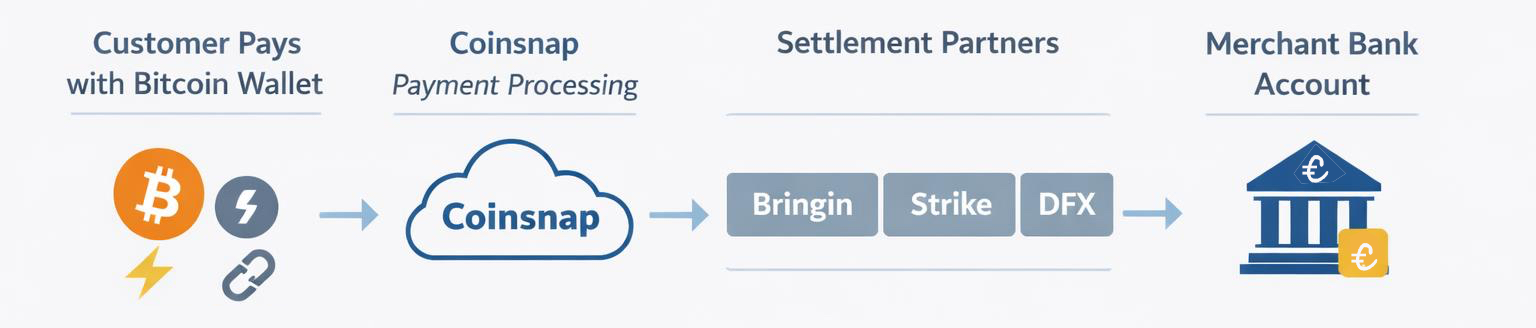

Bitcoin to Bank Account with Coinsnap: How It Works

Coinsnap does not perform Bitcoin‑to‑fiat conversion directly. Instead, it integrates with Bringin, Strike, and DFX.

The flow is simple:

- Customers pay in Bitcoin (Lightning or on‑chain)

- Coinsnap routes the payment to your chosen partner

- The partner converts Bitcoin to fiat

- Funds are credited to your bank account—often within minutes

You never touch Bitcoin unless you want to.

How to Accept Bitcoin and Receive Fiat to Your Bank

- Install Coinsnap in your shop system

- Choose a bank settlement partner (Bringin, Strike, or DFX)

- Complete KYB/KYC with the partner

- Enter your payout details in Coinsnap

- Run a test payment and confirm bank credit

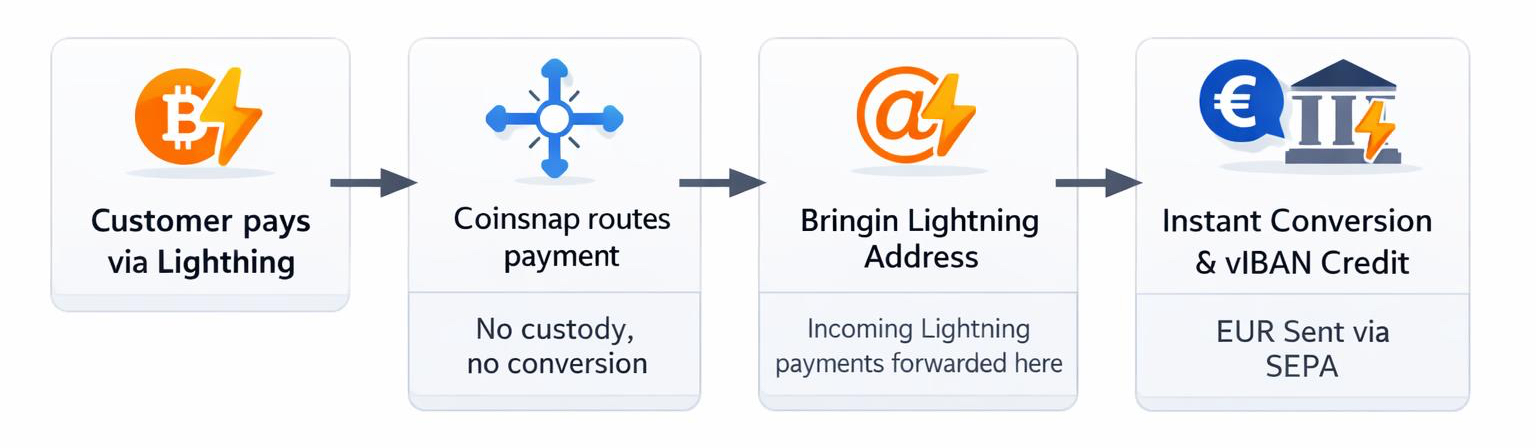

Option 1: Bringin — Accept Bitcoin, Receive Euros via SEPA

Bringin is ideal for EU merchants who want fast, simple euro payouts.

- Lightning payments are forwarded to a Bringin-issued Lightning address

- Funds are converted instantly and credited to a personal IBAN (vIBAN)

- Withdraw to your bank via SEPA Instant

Key points:

- ~1% withdrawal fee

- Starter limit around €10,000/month (expandable)

- Payouts only to bank accounts in the same legal name

Best for merchants who want a clean “accept Bitcoin, receive euros” setup with minimal moving parts.

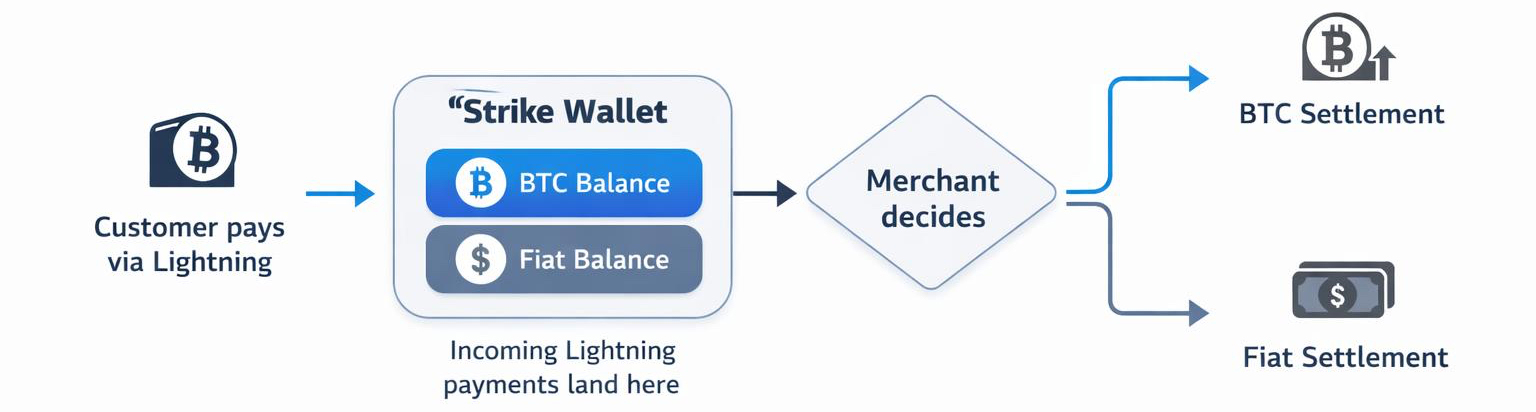

Option 2: Strike — Global Reach with Optional BTC Holding

Strike combines a Lightning address with flexible fiat withdrawals.

- Incoming Lightning payments land in your Strike wallet

- You decide whether to hold BTC or convert to fiat

- Withdraw to your bank in supported countries

Why choose Strike:

- Broad international availability (especially strong in the US)

- Dual wallet model (BTC + cash)

- Flexible conversion timing

Ideal for global merchants or businesses that want to keep some Bitcoin while converting the rest.

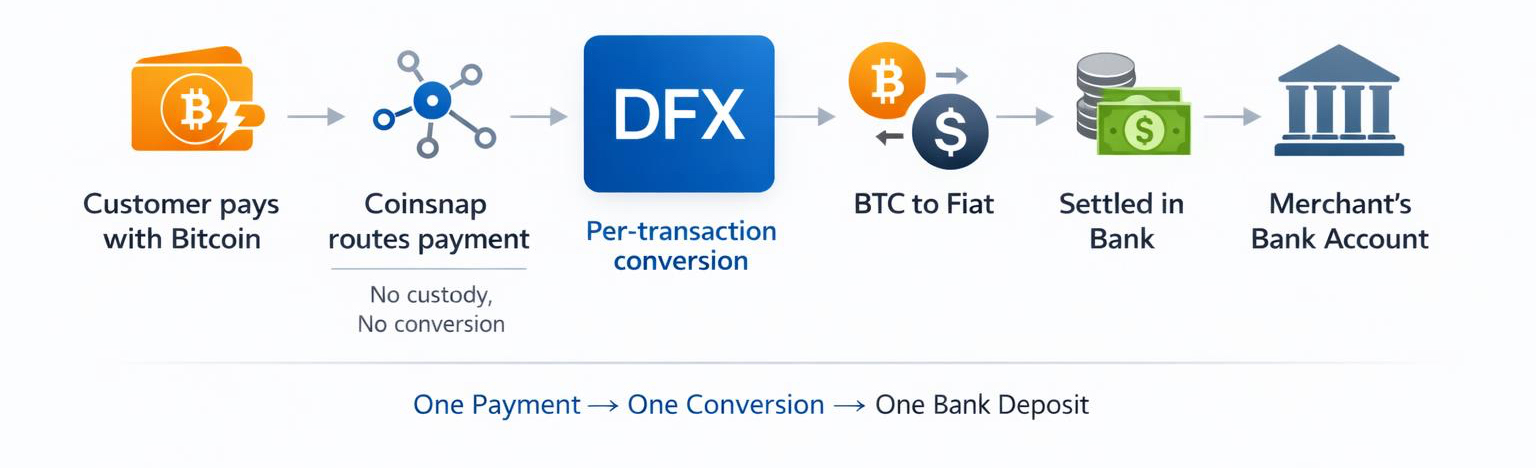

Option 3: DFX — Per‑Transaction Settlement in EUR or CHF

DFX converts and settles each transaction individually.

- Every Bitcoin payment becomes a separate EUR or CHF bank credit

- Works with SEPA‑reachable accounts across the EU, UK, and Switzerland

Highlights:

- Clear audit trail for accounting

- Transparent compliance thresholds

- Strong choice for Switzerland and Europe

Perfect for finance teams that value one‑to‑one reconciliation.

Bringin vs. Strike vs. DFX

| Partner | Region | Fiat | Settlement Style | Best For |

|---|---|---|---|---|

| Bringin | EU / SEPA | EUR | vIBAN → bank | Simple euro payouts |

| Strike | Global | Local | Wallet → bank | Flexibility & reach |

| DFX | EU / CH / UK | EUR / CHF | Per transaction | Accounting clarity |

How to Choose the Right Bitcoin‑to‑Bank Partner

- EU merchants: Bringin or DFX

- US & global businesses: Strike

- Zero BTC exposure: Bank settlement only

- Some BTC holding: Strike or wallet payouts

Coinsnap doesn’t lock you in. Many merchants adjust their payout strategy as demand grows.

Key Takeaways

- Accept Bitcoin without changing your back office

- Eliminate volatility by settling directly to your bank

- Choose the partner that fits your region and accounting needs

- Test once, document the process, and scale confidently

Accepting Bitcoin should expand your market—not complicate your month‑end.

With Coinsnap and the right settlement partner, Bitcoin payments can be as simple as cards or PayPal.

Frequently Asked Questions (FAQ)

Can I accept Bitcoin without holding any Bitcoin?

Yes. With Coinsnap, you can route all payouts directly to your bank account via Bringin, Strike, or DFX. Customers pay in Bitcoin, while you receive euros or dollars—without ever holding BTC.

Do I need KYC or KYB to receive bank payouts?

Yes. While Coinsnap itself does not require KYC for payouts to your own Bitcoin or Lightning wallets, bank payouts require KYB/KYC because Bringin, Strike, and DFX operate on regulated fiat rails.

How fast do Bitcoin payments settle to my bank account?

- Lightning payments: Near-instant on the Bitcoin side

- Bank settlement: Same day to a few business days, depending on the partner and your bank (SEPA Instant is often available in the EU)

What fees should merchants expect?

- Coinsnap: 1% fee per transaction

- Settlement partners: Each partner publishes its own conversion and payout fees (for example, Bringin charges around 1% on withdrawals)

Always review the exact fee schedule during partner onboarding.

Which countries are supported for Bitcoin-to-bank payouts?

- Europe / SEPA: Bringin, DFX

- Switzerland: DFX

- United States & global regions: Strike (availability varies by country)

Availability depends on your business type and local regulations.

Can I split payouts between Bitcoin and fiat?

Coinsnap does not support an automatic split. However, you can receive payments to a Lightning or on-chain wallet and later convert part of your Bitcoin through a third-party exchange or broker.

Is accepting Bitcoin more complex than cards or PayPal?

No. With Coinsnap, Bitcoin checkout integrates directly into your existing shop system. When using bank settlement, reconciliation looks similar to traditional payment methods—often simpler due to lower fees and fewer chargebacks.

Ready to test Bitcoin checkout without changing your finance setup?

Install Coinsnap, connect a bank payout partner, and run a live test in minutes.