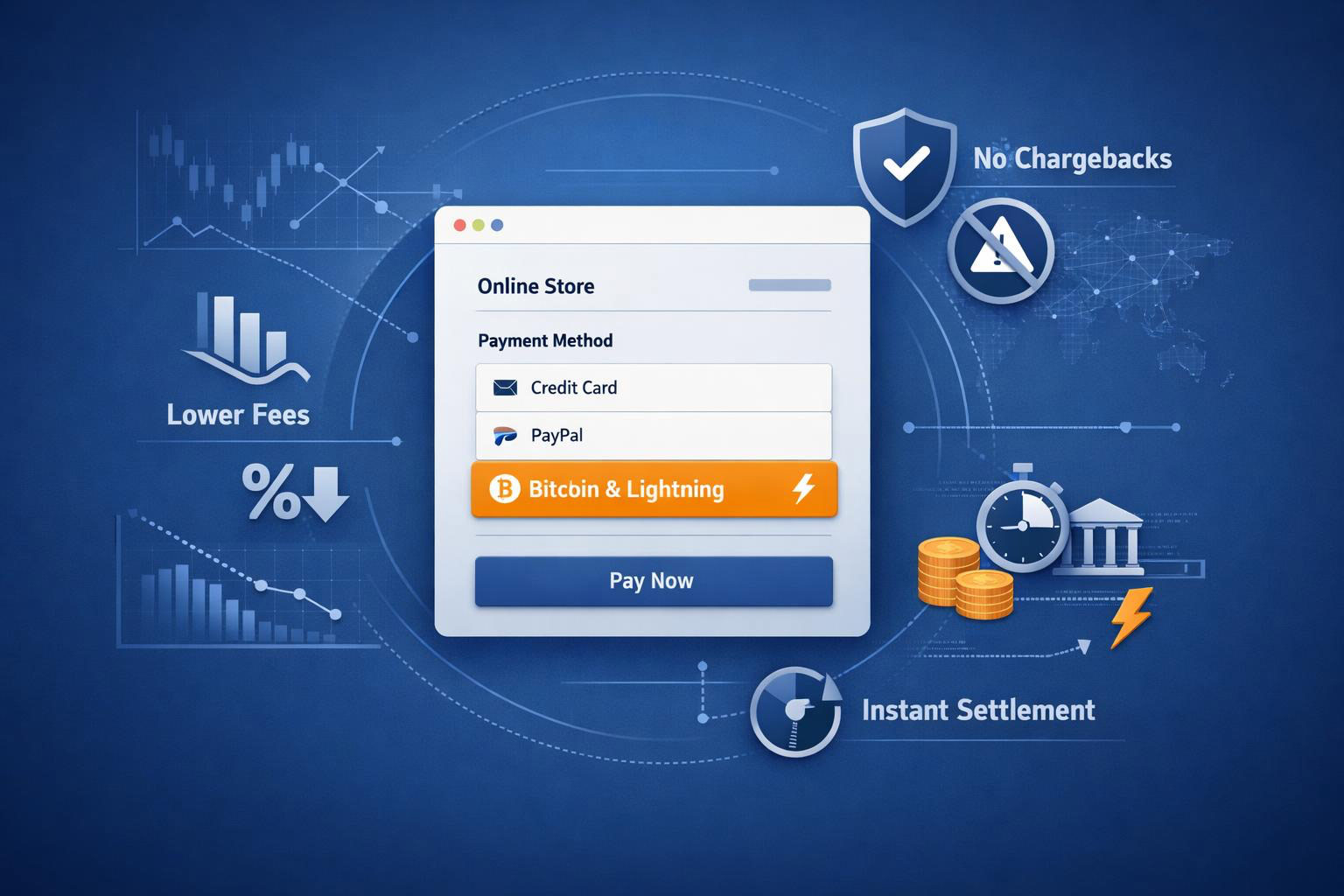

Accepting Bitcoin (including Lightning) can lower fees, end chargebacks, bring global customers, settle instantly to your own wallet, and boost your brand with minimal customer data and 24/7 availability.

Understand Why Bitcoin Payments are Good For Your Business

When you read this post, you’ll understand in a few minutes what Bitcoin payments are in plain language, why they help your business, how they compare to cards and PayPal, what to expect with refunds and volatility, and the easiest way to get started—without jargon.

11 Reasons Why Merchants are Adding Bitcoin Now

If you sell online, you know the pain: high processing fees, surprise chargebacks, international friction, delayed pay-outs, and complicated compliance around sensitive customer data. Bitcoin fixes much of this with a payment rail that is open, global, and built for the internet.

Here are the 11 most important reasons why merchants embracing Bitcoin payment are more likely to improve their bottom line without adding to their workload:

1. Bitcoin Payments are Final

When a customer pays you in Bitcoin—either onchain or over the Lightning Network—the transaction cannot be reversed. That removes the chargeback risk that eats margin and time. You still control your customer service and reputation, but you’re not exposed to arbitrary payment reversals.

2. Fees are Low

Fees are low. Bitcoin payments (On-chain + Lightning) typically cost a fraction of credit card and PayPal fees. Depending on your setup, total processing should be around one percent. For example, Coinsnap charges a flat 1% of the invoice amount instead of 2–4% plus cross‑border and currency fees. Lower costs compound over every order, and they matter most on thin‑margin products and micro‑transactions.

3. It Works Everywhere

Bitcoin is a neutral, internet-native network. You can accept orders from customers in almost any country without opening local merchant accounts, waiting for approvals, or dealing with card incompatibilities. No currency conversion fees, no blocked BINs, fewer cart drops from payment errors.

4. Settlement is Instant and Direct

With Coinsnap Bitcoin payment (on-chain + Lightning), your funds are deposited in your own wallet in seconds—no batch settlements, no rolling reserves. That helps cash flow and reduces operational uncertainty.

5. You can Earn Bitcoin

The simplest way to accumulate Bitcoin is to accept a slice of your sales in it. You don’t have to “buy” it; you earn it from customers. If you’d rather not hold Bitcoin, Coinsnap lets you autoconvert some or all payments to your local currency while still offering Bitcoin at checkout.

6. It’s a Marketing Advantage

Stores that accept Bitcoin often get extra attention on social media, in local communities, and in tech media. Bitcoiners tend to seek out and recommend merchants who support the payment method. Even customers who rarely spend their Bitcoin will follow, share, and talk about your brand.

7. Stronger Loyalty and Fewer Returns

Many merchants notice that Bitcoin customers return products less often and are more intentional buyers. That means fewer fraudulent returns and more stable customer relationships over time.

8. Fits Almost Any Business Model

Physical goods, digital products, subscriptions, services, B2C or B2B, even on-site—Bitcoin works across the board. Lightning also makes true micropayments possible—pay-per-article, pay-per-minute, and in-app purchases that are uneconomical with cards.

9. Better Privacy, Lighter Compliance

Bitcoin payments don’t require you to collect and store sensitive card data. Less data means lower risk and simpler processes for your team. Customers who care about privacy feel safer, which can lift conversion.

10. Always On

Bitcoin settles around the clock, including weekends and holidays. If you sell globally, that reliability matters.

11. Modern Brand Image

Offering Bitcoin signals that your business is innovative, open to customer choice, and internet-native—especially attractive to digital or crypto audiences.

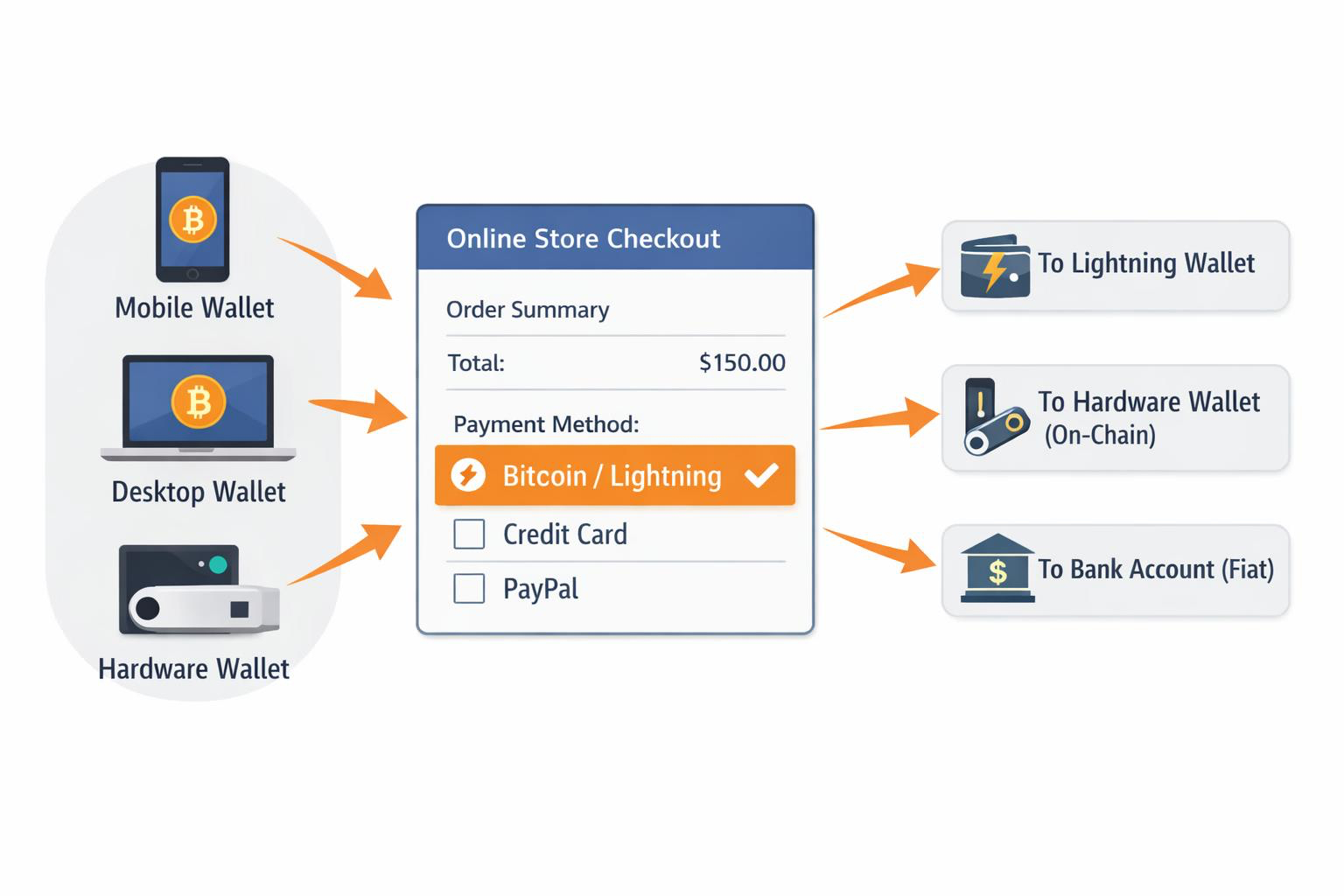

What Bitcoin payments look like in practice

- Customer pays from any Bitcoin or Lightning wallet. There are no “walled gardens”—your checkout can accept payments from the wallets your customers already use.

- You choose how you get paid. Receive Bitcoin straight to your Lightning wallet, to a hardware wallet for larger on-chain payments, or through a Coinsnap partner (Bringin or DFX) that can autoconvert part (or all) to fiat.

- You keep control. No lengthy provider approvals, fewer account freezes, and no rolling reserves. You can still offer refunds as store credit, Bitcoin returns, or fiat refunds according to your policy.

FAQ – Clear answers to common questions about Bitcoin payments

Do I have to hold Bitcoin?

No. With Coinsnap, you can choose to keep your Bitcoin in either your Lightning or on-chain wallet, or automatically convert it into euros and have it paid out to your bank account. In the latter case, you can choose between Coinsnap’s partners Bringin, Strike and DFX.

If payments are final, how do refunds work?

Exactly how you decide. “Irreversible” means there are no chargebacks. You can still issue refunds—either by sending Bitcoin back to the customer, providing store credit, or refunding in fiat.

Are fees really lower?

Typically, yes—especially on Lightning and for international orders. Exact fees depend on your setup and provider, but, e.g. with Coinsnap you’ll see total costs of one percent instead of 2–4% plus extras.

What about taxes and accounting?

With Coinsnap, you can handle Bitcoin sales just like any other sale—all relevant information is available in your dashboard and can be easily exported for your accountant or tax authorities.

Is it legal?

In most countries it’s legal to accept Bitcoin for goods and services. Follow your local regulations for invoicing, taxes, and consumer protection like you do with other payments.

Quick takeaways

Lower fees and no chargebacks protect your margin; global, 24/7, instant settlement improves cash flow; less customer data reduces risk; Lightning unlocks micropayments and new digital models; offering Bitcoin widens your audience and strengthens your brand.

A simple way to get started with Bitcoin payments

- Start small. Add Bitcoin and Lightning as an extra payment option alongside cards and PayPal.

- Choose a Bitcoin payment module that supports any customer wallet (like Coinsnap) and, if you prefer, automatic conversion to your local currency.

- Place the Bitcoin option in your checkout, add a short “We accept Bitcoin” line on your homepage and product pages, and let your audience know in a brief post or email.

With Coinsnap, you can also offer a Bitcoin discount to encourage your customers to choose Bitcoin payments over conventional payment options.

Measure results for 30–60 days: fees saved, chargebacks avoided, international orders completed, and new customers reached. Keep what works, scale gradually, and consider offering small incentives (for example, a discount or a “Bitcoin-only” perk) to drive adoption.

Conclusion: Bitcoin payments are a practical business tool

Accepting Bitcoin payments is a practical business move, not a science project. You reduce payment costs, remove chargeback risk, reach global customers, settle funds instantly, and strengthen your brand—all while collecting less sensitive data.

Add it as a lightweight option, measure the impact, and let your customers decide. In a competitive ecommerce market, the merchants who offer faster, cheaper, and more open payment choices will win the order—and the loyalty that follows.

Bottom line: adding Coinsnap to your store is absolutely risk-free—no setup or monthly costs, no costly implementation, and no changes to your existing checkout flow. You simply enable it alongside your current payment methods and start accepting Bitcoin, gaining all the advantages discussed above with zero disruption or downside.

Do you need help? Coinsnap is ready to support you in getting started with Bitcoin payments in your store. Speak with our experts if you’re unsure which module best fits your business goals, or request our free installation service if you prefer professional assistance with setting up Coinsnap in your shop system.