WooCommerce Bitcoin Cash-Out (Simple Introduction)

Many WooCommerce shops want the reach and tiny fees of Bitcoin and Lightning at checkout, but still need money to land in the bank in euros, dollars or pounds. That keeps cash flow smooth, bookkeeping simple, and avoids price swings.

This guide explains your payout choices in plain English and shows easy ways to set them up in WooCommerce—so you can go live fast.

Why settling to fiat matters

Some stores don’t want to keep Bitcoin on the books because it adds extra accounting work. Others need local currency to pay suppliers, salaries and taxes. And some prefer not to carry price risk if Bitcoin moves after a sale.

Settling to fiat at, or soon after, a Bitcoin payment solves all three problems: clean books, predictable cash flow, and no surprise losses from exchange-rate swings.

Your WooCommerce Bitcoin cash-out options

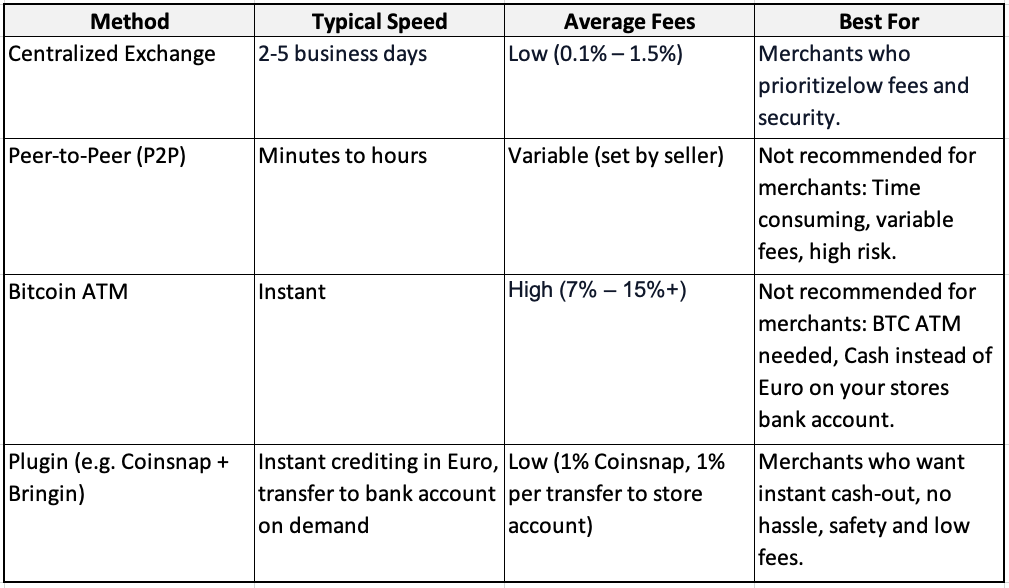

There are several practical ways to turn WooCommerce Bitcoin sales into euros or other currencies in your bank. Here are the most common ones:

1) Exchange to bank (sell BTC, withdraw to IBAN)

This is the “sell on an exchange, withdraw to your bank” route. You receive Bitcoin, send it to a trusted exchange account, sell it for EUR/USD/GBP, and withdraw to your bank.

It usually has the lowest fees but takes a little time and requires an exchange account with ID checks.

2) Peer-to-peer sales

You sell directly to a buyer on a marketplace and agree a bank transfer or another payment method.

It can be fast and flexible, but you must use platforms with escrow and good reputation systems, and you’ll need to verify you’ve been paid before releasing the Bitcoin.

3) Bitcoin ATMs (instant cash, higher fees)

You send Bitcoin to a Bitcoin ATM and receive banknotes.

It’s the fastest way to get physical cash, but fees are usually much higher than other routes and daily limits may apply.

4) Plugins for Bitcoin Cash-out directly to your IBAN

There’s very convenient flavour that feels like option 1 but without moving coins yourself: some plugins connect your checkout to a service that auto-converts Lightning or on-chain payments into euros and credits them to an account in your name.

A popular example is Coinsnap together with Bringin. Customers pay in Bitcoin, you see euros arrive—instantly—without touching an exchange screen.

Which way should you choose for cashing out Bitcoin?

Pick the exchange route if you want low fees and can wait for a bank transfer. If you want the easiest life inside WooCommerce, use a plugin that automates the euro payout for you and keeps the checkout fast—Coinsnap + Bringin is the simplest example.

Recommended strategies that keep WooCommerce Bitcoin cash-out simple

If you like “set and forget,” Coinsnap with Bringin is hard to beat. Coinsnap handles the Bitcoin and Lightning checkout, Bringin converts Lightning payments into euros and credits an IBAN in your name, in seconds. You can also use Coinsnap with DFX if you prefer to work with a Bitcoin exchange.

If you prefer a single provider that does everything from acceptance to daily bank payouts, look at CoinGate or OpenNode. You’ll open an account, pass standard ID checks for businesses, install their WooCommerce plugin, and choose your payout settings. Both support Bitcoin; CoinGate also offers many payout currencies and extra merchant tools.

Bitcoin cash-out: exchanges vs. WooCommerce plugins—what to know

Bitcoin exchange

Selling on a centralised exchange is the classic route: pick a regulated platform that serves your country, create an account, pass KYC, link your bank, send in your Bitcoin, sell it for EUR/GBP/USD, then withdraw to your account. It’s familiar and flexible, but it’s a separate workflow from your shop.

Know the costs and timing. Exchanges charge a trading fee when you sell and a withdrawal fee when you move money to your bank. Payouts aren’t instant—bank transfers typically take 1–5 business days.

WooCommerce Bitcoin cash-out plugins

If you want less manual work, specialised WooCommerce Bitcoin fiat settlement plugins can fold this into checkout and pay out to your bank on an instant or daily schedule, so cash flow and reconciliation stay simple.

A good example is the Coinsnap + Bringin combination:

Install the Coinsnap for WooCommerce plugin, open a Bringin account, and paste your Bringin Lightning address into Coinsnap. From then on, Lightning payments at checkout are auto-converted to euros and credited instantly to your personal IBAN at Bringin—no extra steps in your shop. Coinsnap itself doesn’t require KYB for BTC/LN to your own wallet; Bringin does standard KYC for the euro account.

Plan for costs and flow. Typical fees are Coinsnap (1%) plus Bringin (1% when you withdraw to your bank). Funds hit your Bringin IBAN immediately; bank withdrawals use SEPA Instant in most cases.

Coinsnap Bringin setup in a nutshell

The steps are straightforward. Install the plugin in WordPress, switch it on in WooCommerce → Settings → Payments, and paste the keys or address the provider gives you. If you choose Coinsnap with Bringin, you add your Bringin Lightning address in the Coinsnap dashboard and you’re done—run a €1 Lightning test and watch euros hit your account. If you choose an exchange or a different provider, follow their simple connect flow and do the same €1 test.

If you need a detailed installation guide, read this article!

How to ensure clean accounting?

Record each order at the euro amount shown at payment time. Keep the Bitcoin amount, the exchange rate used, the order number and the transaction ID or Lightning payment hash. If you use automatic euro payouts, your books just show normal bank income and you don’t carry Bitcoin on the balance sheet.

If you keep some Bitcoin and convert later, you’ll track any gain or loss between the day of sale and the day you convert. To make life easy, Coinsnap connects to CoinTracking, which pulls in your transactions and produces tax-ready reports. It’s a popular tool accountants recognise.

WooCommerce Bitcoin cash-outs: compliance and refund essentials

Services that pay out to banks will ask for standard ID checks and run routine compliance screening on payouts. If money goes straight to your own wallet first, there are usually no ID checks at checkout, but you still follow local rules for invoices, VAT and data protection.

Bitcoin and Lightning have no chargebacks, so refunds are simply new payments you send back to the customer. Publish a clear refund policy, ask customers for a fresh address or Lightning invoice, and note the details in your records.

Quick answers for your questions

Can WooCommerce settle Bitcoin to my bank?

Yes. Use a plugin that offers bank payouts, or pair Coinsnap with Bringin to auto-convert Bitcoin Lightning payments into euros.

How long does a Bitcoin cash-out take?

On a centralised exchange, the sale goes through right away, but getting the cash to your bank takes longer—most withdrawals arrive in one to five business days, depending on the exchange and your bank.

With Coinsnap + Bringin, Bitcoin Lightning payments are auto-converted to euros and credited to your Bringin IBAN immediately; moving those euros to your bank is a separate withdrawal that typically completes instantly via SEPA Instant, as soon as you initiate it.

Does Lightning work with bank payouts?

Yes. With Coinsnap and Bringin, Lightning payments can be turned into euros automatically. Other providers can settle daily.

Do I need to verify my identity?

For bank payouts, yes. For pure Bitcoin to your own wallet, usually not. If you later convert to fiat, the off-ramp will require ID.

What is the easiest path to euros from Lightning sales?

Coinsnap with Bringin: add your Bringin Lightning address in Coinsnap and euros show up in your IBAN, instantly.

Bottom line: choose the cash-out flow that matches your shop, not someone else’s

If you only cash out now and then, a reputable exchange is perfectly fine. You’ll likely get competitive rates, full control over when you sell, and a familiar “sell → withdraw to bank” flow. The trade-off is manual work: you move funds yourself, wait 1–5 business days for the bank transfer, and reconcile orders separately. For low volume or occasional treasury moves, that’s acceptable and keeps things simple.

If you want daily, no-friction operations, plugin-based cash-out wins. Solutions wired into WooCommerce (e.g., Coinsnap + Bringin or gateways like CoinGate/OpenNode/etc.) turn each WooCommerce Bitcoin checkout into money that lands in fiat with minimal effort. You get faster cash flow, cleaner accounting (rate-locked at payment time), and fewer back-office steps. The trade-offs are processor and settlement fees. Coinsnap + Bringin processes Bitcoin or Lightning fast at checkout, then auto-credits EUR to an IBAN—perfect when you want instant, fully automated Bitcoin cash-out.