WooCommerce Bitcoin Fiat Settlement: Deep Dive for Merchants (2025)

Many WooCommerce stores want the reach and low fees of Bitcoin/Lightning at checkout but still need bank-ready EUR/USD/GBP for cash flow, simpler accounting, and lower volatility risk. So they are looking for a practical WooCommerce Bitcoin fiat settlement solution.

In this guide for merchants who already have some experiences with Bitcoin, custodial and non-custodial wallets, and Lightning payments, we’ll lay out the three practical paths at a glance—self-custody only (keep BTC), automatic fiat settlement (instant or daily payouts to your bank), and a hybrid approach (keep some BTC, settle the rest).

You’ll get clear options, a side-by-side comparison of fees, payout speed, KYC/KYB, and Lightning support, plus short setup playbooks so you can go live with the right fiat-settlement flow fast.

Why does fiat settlement matter for Woo merchants?

There are three main reasons why merchants prefer fiat settlement for their WooCommerce Bitcoin payments:

Accounting/Management

If you keep Bitcoin on your books, you must track cost basis, FX gains and losses, and reconcile on-chain/Lightning records—work many merchants would rather avoid.

Liquidity/Cashflow

Day to day, some stores need euros to pay suppliers, payroll and taxes; automatic settlement delivers cash flow and liquidity where it’s actually used.

Volatility Risk Neutralising

Fiat settlement neutralises price volatility: converting at payment time removes the risk that BTC moves against you before you off-ramp.

Long story short: fiat settlement simplifies compliance and audits, reduces friction with banks and accountants, and makes forecasting predictable—so finance teams stay happy while your checkout stays fast and global.

Fiat settlement 101 (custody models & trade-offs)

Before you choose a payout route, it helps to understand the two basic custody models and their trade-offs. Below we outline how custodial processors differ from non-custodial + off-ramp setups, and the key questions every merchant should weigh—fees, payout speed, supported currencies, Lightning readiness, compliance burden, and the quality of accounting exports.

Custodial processors

… such as CoinGate, BitPay, OpenNode and NOWPayments—require KYC/KYB and charge platform fees. On the other side they handle payouts for you and offer broad fiat rails.

Non-custodial plus off-ramp setups

… such as Coinsnap with Bringin or DFX, let you accept your WooCommerce Bitcoin payments via Lightning/on-chain, without funds sitting with a processor. They auto-convert to EUR on receipt (Bringin) or off-ramp on a schedule (DFX), keeping checkout friction low.

When evaluating these options, weigh fees, payout speed, supported currencies, Lightning support, compliance burden and the quality of accounting exports.

When to use which (quick decision aid)

You want zero BTC on books, simplest ops

Coinsnap + Bringin (Lightning → instant EUR credit to IBAN) or BitPay/CoinGate/OpenNode with daily payouts would be your best choice.

You want choice

If you are looking for a hybrid solution that provides the fiat cash you need for day-to-day business but want to keep some Bitcoin—Lightning default with Coinsnap; on-chain fallback; periodic off-ramp via Bringin/DFX or a custodial gateway would be your best choice.

You want maximum control, can handle custody

Self-custody + periodic OTC/DFX exchange; requires internal accounting process. One example is BTCPay Server + your own Lightning node + regulated exchange (e.g. weekly off-ramp).

The best WooCommerce Bitcoin Fiat Settlement plugins (short descriptions)

Of course, there are dozens of WooCommerce Bitcoin payment plugins that offer some form of fiat settlement. Drawing on our comparison of the ten best WooCommerce Bitcoin payment plugins, we now set out six solutions that suit different preferences, are proven in practice, and are straightforward to install:

- Coinsnap + Bringin (Lightning → EUR): Non-custodial checkout via Coinsnap; auto-convert Lightning receipts to EUR IBAN in real time with Bringin; simple Woo plugin; supports on-chain; no KYB at Coinsnap for BTC/LN to your wallet (Bringin requires KYC for EUR account).

- Coinsnap + DFX (Lightning/On-chain → bank payouts): Keep BTC until you off-ramp via DFX; suitable if you sometimes hold BTC but still want easy fiat payouts.

- CoinGate: Custodial gateway with Lightning + on-chain acceptance and fiat settlement (EUR/USD/GBP); Woo plugin; KYB; flat processing fee.

- BitPay: Enterprise-grade, Lightning + on-chain for BTC; broad fiat rails, strong compliance; Woo plugin; KYB; tiered fees.

- OpenNode: Bitcoin-focused (Lightning + on-chain) with fiat settlement; Woo plugin; KYB; straightforward merchant tools.

- NOWPayments: Wide coin coverage; no Lightning for BTC in many setups (primarily on-chain); fiat settlement via partners; Woo plugin; KYB for fiat.

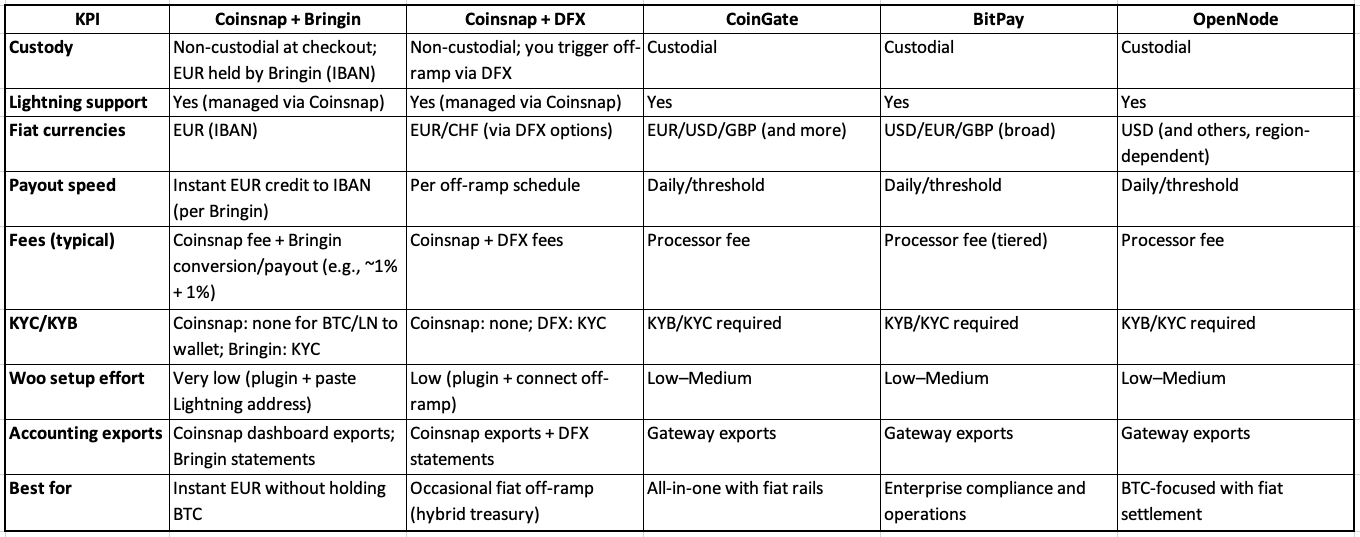

Detailed comparison of the most important features (decision matrix)

How does it work? Setup guide (schematic)

It’s actually very simple to set up fiat settlement for your WooCommerce Bitcoin payments. Here, we’ll show you the few steps you need to take:

1) Coinsnap + Bringin (fastest path to EUR)

- Install Coinsnap for WooCommerce → activate.

- In Coinsnap, add store and Lightning address.

- Open Bringin account (KYC), claim Lightning address (you@bringin.xyz).

- In Coinsnap → Wallet, paste Bringin Lightning address.

- Enable Coinsnap under Woo → Settings → Payments; test a €1 Lightning order.

→ Result: Customer pays Lightning, you receive EUR in IBAN instantly (per Bringin).

Read our Coinsnap + Bringin installation guide!

2) Coinsnap + DFX (hybrid treasury)

- Steps 1–2 as above (use your own Lightning wallet).

- Create DFX account; connect settlement flow.

- Periodically convert BTC to EUR/USD/CHF and withdraw to bank.

→ Result: Keep BTC until you decide to off-ramp.

3) CoinGate / BitPay / OpenNode (custodial)

- Create merchant account (KYB/KYC).

- Install Woo plugin; paste API credentials.

- Select Lightning + on-chain, choose fiat settlement currency, set payout schedule.

- Test order; verify order status mappings.

By now you’ve seen the main types of Bitcoin fiat settlement, the most recommendable plugins, and exactly how to install them.

The next question is what happens after you go live: how do you handle accounting and taxes? In the following section we’ll explain what to record, how to recognise revenue, and the simplest way to keep your books compliant.

Clean Books, No Surprises: Practical Steps for Safe Accounting

Before you flip the switch, align your bookkeeping so every Bitcoin sale maps cleanly to your ledgers and tax rules. Use the checklist below to recognise revenue correctly, decide how fiat-settled vs hybrid flows appear in your books, and streamline record-keeping with simple exports and tooling.

Revenue recognition (what to record and when)

Recognise each sale at the fiat value at the moment of payment, using the rate-locked invoice amount. For every order, capture the BTC amount, the applied exchange rate, the fiat value, order ID, and, if it’s available, the on-chain TXID or Lightning payment hash.

These fields give you a complete audit trail, make reconciliations straightforward, and ensure invoices and refunds can be matched cleanly in your books.

If you use fiat settlement

With custodial payouts (e.g., CoinGate/BitPay/OpenNode) or Coinsnap + Bringin, your ledger simply shows EUR/USD/GBP received; you do not carry a BTC inventory position.

That typically simplifies VAT handling and removes FX (foreign exchange) gain/loss tracking on treasury, because conversion happens at the point of sale and cash hits your bank (or IBAN) in the accounting currency.

If you run a hybrid/self-custody model

When you keep some BTC on the balance sheet and convert later, record revenue at the checkout’s fiat value, then separately track foreign-exchange gains or losses between payment time and the eventual conversion to fiat.

A simple policy (e.g., weekly off-ramp of a fixed percentage) plus consistent tagging of transactions will keep forecasting and month-end close predictable.

Coinsnap + CoinTracking (automation for clean books)

If you retain any BTC/LN, connecting Coinsnap to CoinTracking automates imports of your transactions, computes cost basis and realised/unrealised P&L, and produces tax-ready reports you can hand to your accountant—cutting manual spreadsheet work to near zero.

Note: CoinTracking is a popular crypto portfolio and tax tool used to track transactions across wallets/exchanges and generate compliant reports.

Compliance & refunds (quick reality check)

Before you switch on fiat settlement, align how you’ll handle compliance and refunds.

If you use a custodial gateway or an off-ramp partner (e.g., bank payouts), expect KYB/KYC and AML/sanctions screening, plus provider terms that govern refunds and dispute handling.

In a non-custodial flow (BTC/LN to your own wallet) there’s usually no KYB at the checkout stage, but you still must meet local rules on invoicing/VAT, consumer rights, data protection, and record-keeping.

FAQ

Can WooCommerce settle Bitcoin to my bank?

Yes—use a fiat-settling provider (CoinGate, BitPay, OpenNode) or non-custodial Coinsnap with Bringin/DFX.

Is Lightning compatible with fiat settlement?

Yes—Lightning receipts can be auto-converted (e.g., Coinsnap + Bringin) or settled daily via custodial gateways.

Do I need KYB?

For custodial gateways and fiat payouts, yes. For pure BTC/LN to your wallet via Coinsnap, no; fiat off-ramp partners require KYC/KYB.

What’s the easiest way to get EUR from Lightning sales?

Coinsnap + Bringin: paste your Bringin Lightning address in Coinsnap and receive EUR IBAN instantly.

What is realised vs unrealised P&L?

Realised P&L is the profit or loss you actually lock in when a position is closed—e.g., when you convert BTC to EUR/USD/GBP. It hits your income statement.

Unrealised P&L is the paper gain or loss while you still hold the asset. It fluctuates with price and isn’t locked in. Whether you book revaluations depends on your accounting policy/standards.

What is AML/sanctions screening in this context?

Compliance checks by processors/off-ramps to verify identity and block prohibited transactions. If you use custodial or fiat-payout services, expect KYC/KYB; pure non-custodial BTC→wallet flows are typically not screened at checkout.

Get started with WooCommerce Bitcoin Fiat Settlement

Install Coinsnap for WooCommerce

Install Bringin

Get your Coinsnap account