WooCommerce Bitcoin Fiat Settlement: Deep Dive for Merchants (2025)

Many WooCommerce stores want the reach and low fees of Bitcoin/Lightning at checkout but still need

bank-ready EUR/USD/GBP for cash flow, simpler accounting, and lower volatility risk.

So they are looking for a practical WooCommerce Bitcoin fiat settlement solution.

In this guide for merchants already familiar with Bitcoin, wallets, and Lightning, we’ll outline

the three practical paths at a glance—self-custody only (keep BTC),

automatic fiat settlement (instant or daily bank payouts),

and a hybrid approach (keep some BTC, settle the rest).

You’ll get clear options, a comparison of fees, payout speed, KYC/KYB,

Lightning support, and setup steps to go live fast.

Why does fiat settlement matter for Woo merchants?

There are three main reasons why merchants prefer fiat settlement:

Accounting / Management

If you keep Bitcoin on your books, you must track cost basis, FX gains/losses,

and reconcile on-chain/Lightning records—a burden most merchants avoid.

Liquidity / Cashflow

Stores often need euros to pay suppliers, payroll, and taxes; automatic settlement

delivers cash flow and liquidity where it’s needed.

Volatility Risk Neutralising

Fiat settlement neutralises price volatility: converting at payment time removes risk.

It simplifies compliance, reduces friction with accountants,

and keeps forecasts predictable.

Fiat settlement 101 (custody models & trade-offs)

Before choosing a payout route, understand the two custody models:

custodial processors and non-custodial + off-ramp setups.

Custodial processors

Platforms like CoinGate, BitPay, OpenNode, and NOWPayments require

KYC/KYB and charge fees but handle payouts and offer broad fiat rails.

Non-custodial + off-ramp setups

Solutions like Coinsnap + Bringin or DFX let you accept Bitcoin

via Lightning or on-chain, auto-converting to EUR or off-ramping later.

When to use which (quick decision aid)

Zero BTC on books

Use Coinsnap + Bringin for Lightning → instant EUR credit to IBAN,

or custodial gateways (BitPay, CoinGate, OpenNode) for daily payouts.

You want choice

Choose a hybrid model: accept Bitcoin via Coinsnap,

keep some BTC, and off-ramp through Bringin or DFX.

Maximum control

Opt for self-custody + periodic OTC/DFX exchange—ideal for merchants

comfortable handling their own wallets and bookkeeping.

The best WooCommerce Bitcoin Fiat Settlement plugins

Here are six proven solutions from our

plugin comparison:

- Coinsnap + Bringin (Lightning → EUR): Non-custodial checkout, instant EUR IBAN, supports on-chain.

- Coinsnap + DFX: Keep BTC, off-ramp later; flexible hybrid treasury.

- CoinGate: Custodial Lightning + on-chain with fiat settlement (EUR/USD/GBP).

- BitPay: Enterprise-grade BTC gateway; KYB required; multiple currencies.

- OpenNode: Bitcoin-only, KYB, instant or daily fiat payouts.

- NOWPayments: Multi-coin, no Lightning; fiat via partners; KYB for fiat.

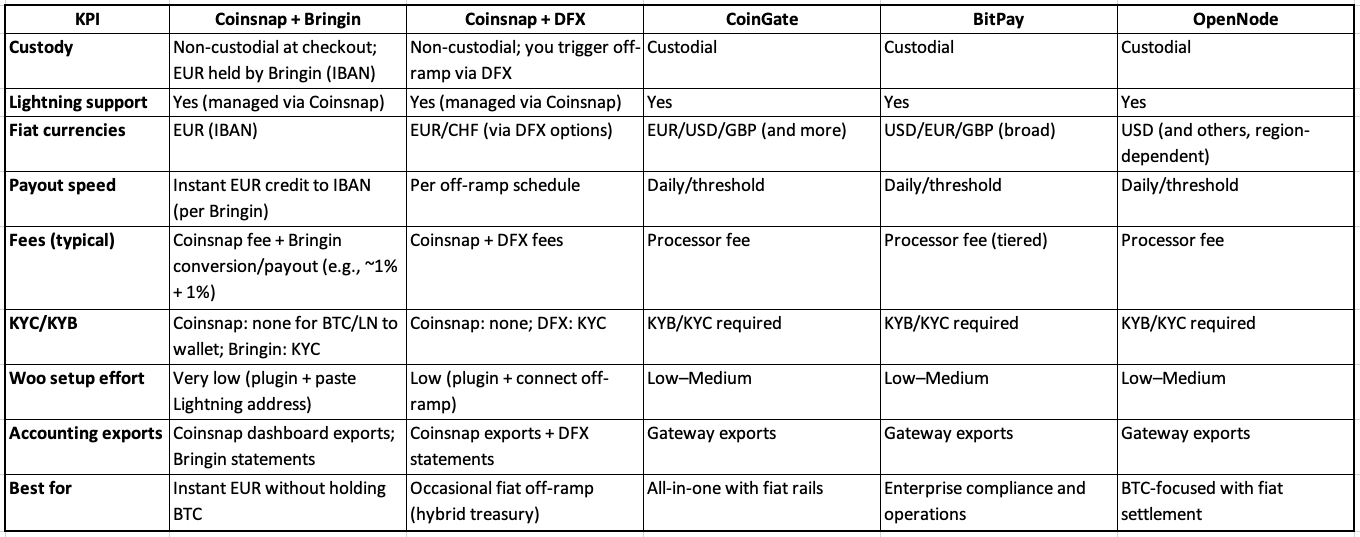

Detailed comparison of the most important features (decision matrix)

Click here to download the Excel comparison.

How does it work? Setup guide

1) Coinsnap + Bringin (fastest path to EUR)

- Install Coinsnap for WooCommerce and activate it.

- Add store and Lightning address in Coinsnap.

- Open Bringin account (KYC) and claim your Lightning address.

- Paste Bringin address into Coinsnap → Wallet.

- Enable Coinsnap under Woo → Settings → Payments; test €1 order.

→ Result: instant EUR credit to IBAN.

Installation guide.

2) Coinsnap + DFX (hybrid treasury)

- Install Coinsnap and connect your Lightning wallet.

- Create DFX account and connect settlement flow.

- Periodically convert BTC to EUR/USD/CHF and withdraw.

→ Result: Keep BTC until you off-ramp.

3) CoinGate / BitPay / OpenNode (custodial)

- Create merchant account (KYB/KYC).

- Install Woo plugin, paste API credentials.

- Select Lightning + on-chain, choose fiat currency, set payout schedule.

- Test and verify order mapping.

Clean Books, No Surprises: Practical Steps for Safe Accounting

Revenue recognition

Record each sale at the fiat value at payment time. Keep BTC amount, rate, fiat value, order ID, and TXID/payment hash for full auditability.

If you use fiat settlement

With Coinsnap + Bringin or custodial gateways, your ledger shows EUR/USD/GBP received;

you don’t carry BTC inventory. This simplifies VAT and removes FX tracking.

If you run a hybrid/self-custody model

Record revenue at fiat value, then track FX gains/losses between sale and conversion.

Use a fixed off-ramp policy to keep forecasts clean.

Coinsnap + CoinTracking automation

Connect Coinsnap to CoinTracking

to automate imports, calculate P&L, and generate tax-ready reports.

This is general information, not tax advice—consult your accountant.

Compliance & refunds

Custodial gateways and off-ramps (bank payouts) require KYB/KYC,

AML, and refund policies.

Non-custodial flows (BTC/LN → wallet) have no checkout KYB but still need

VAT, consumer rights, and data compliance.

Refunds are new payments—always verify address/invoice and log full details

(order ID, fiat rate, TXIDs).

FAQ

Can WooCommerce settle Bitcoin to my bank?

Yes—use CoinGate, BitPay, OpenNode, or non-custodial Coinsnap with Bringin/DFX.

Is Lightning compatible with fiat settlement?

Yes—Lightning receipts can be auto-converted via Coinsnap + Bringin or settled daily via custodial gateways.

Do I need KYB?

Yes for custodial/fiat providers; no for pure BTC/LN to your wallet (Coinsnap only).

What’s the easiest way to get EUR from Lightning sales?

Coinsnap + Bringin: paste your Lightning address and receive EUR instantly in your IBAN.

What is realised vs unrealised P&L?

Realised P&L: profit/loss on conversion to fiat.

Unrealised P&L: paper gains/losses while holding BTC.

What is AML/sanctions screening?

Processor compliance checks that verify identity and block prohibited transactions.

Required for fiat off-ramps; not typical for non-custodial flows.